«According to data from CNBC, 81 percent of stocks in the IBB with a market cap of more than $500 million are down more than 10 percent from

The $9.49 billion IBB is home to 145 stocks, but the fund’s top 10 holdings combine for nearly 60% of its weight. IBB’s top four holdings combine for nearly a third of the ETF’s weight and in the case of IBB, which is a

For traders with a taste and tolerance risk looking to bet on further downside for IBB, the newly minted ProShares UltraPro Short NASDAQ Biotechnology (ZBIO) is an idea to consider. ZBIO, which debuted in late June, attempts to deliver three times the daily inverse performance of the Nasdaq Biotech Index, IBB’s underlying benchmark. [Don’t Mess With the Leveraged Biotech Bull]

Gven the lofty

In what is a troubling sign for IBB in the

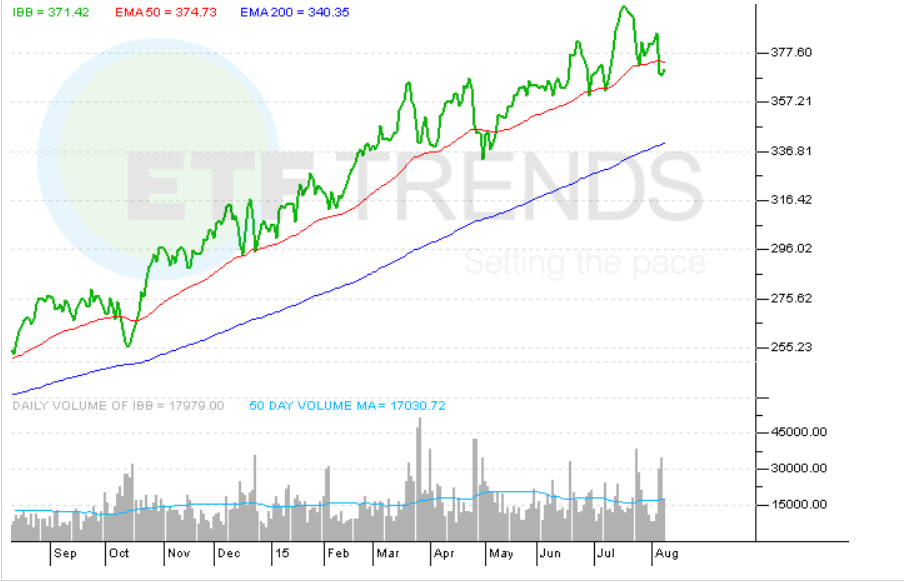

iShares Nasdaq Biotechnology ETF

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.

http://finance.yahoo.com/news/biotech-etfs-try-