It’s not an easy environment for health-care investors, with the sector front and center of political debates, but a bigger concern might be stemming from a key regulator: the U.S. Food and Drug Administration.

The recent Novartis AG data controversy and this week’s rejection of Sarepta Therapeutics Inc.’s newest drug for Duchenne muscular dystrophy have increased concerns that the agency might be toughening its stance on the biotech industry, according to Sven Borho, a managing partner and portfolio manager at OrbiMed Advisors LLC. The investment firm manages over $13 billion across public and private companies globally.

The recent Novartis AG data controversy and this week’s rejection of Sarepta Therapeutics Inc.’s newest drug for Duchenne muscular dystrophy have increased concerns that the agency might be toughening its stance on the biotech industry, according to Sven Borho, a managing partner and portfolio manager at OrbiMed Advisors LLC. The investment firm manages over $13 billion across public and private companies globally.A shift “is tough to predict,” Borho said in an interview. But “if suddenly the FDA would get less lenient, this would have more of an impact on a lot of the smaller biotech companies than anything coming out of Washington, D.C.”

The FDA, led by acting commissioner Ned Sharpless after Scott Gottlieb resigned in April, said earlier this month that a Novartis subsidiary had manipulated some of the data it submitted for the approval of its expensive gene therapy. Congress has taken notice, with senators urging the agency to hold the company accountable.

“Political pressure could have a very big impact,” Borho said.

Under Gottlieb, the FDA was viewed as friendly to the industry, approving a record number of new and generic drugs during his tenure. He had a background in consulting for the industry while Sharpless came to FDA from the National Cancer Institute, leaving observers to question what his emphasis would be as head of FDA.

Other topics discussed with the investor include:

Drug Pricing

- “Nothing too dramatic will change” but some pricing legislation will get passed regardless of who wins the White House in 2020

- “The industry has to give something,” he said

- President Donald Trump is running out of time for meaningful reforms at this point

- “Does the Senate bill have a chance? Maybe yes”

- However, the measure may not be seen as enough by others in Congress; pending the outcome of the election, something more comprehensive could be done

Political Volatility, China

- Broadly, health-care stocks will continue to underperform the market until closer to the 2020 election

- Segments that have offered safe havens in the sector so far have been medical technology, diagnostics and tools

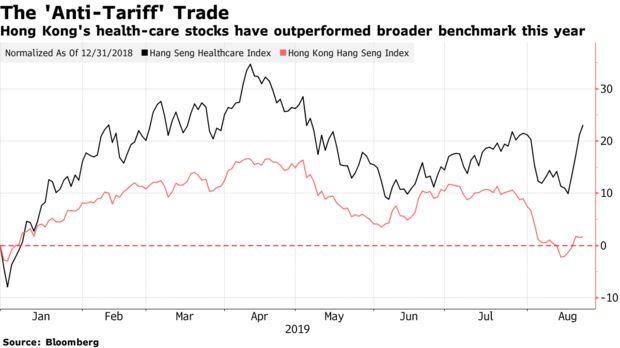

- There are opportunities in biotech, and in emerging markets. Health-care stocks in China, for example, have been the “anti-tariff” trade and have performed well

- Anticipates China’s biotech space is going to be “exploding,” with a lot of private money chasing the industry

M&A

- The biotech sector is likely to see smaller deals in the future, because mega-mergers have not been perceived well by investors so far

- Could see a couple of tuck-in deals get done later this year and before the election

- There is no appetite for single-drug companies that require a large salesforce anymore; companies are more interested in platform technologies that can offer next-generation treatments

- Key areas to watch for potential deals include oncology, gene therapy and the central nervous system space

- Biotech M&A targets include: Sarepta Therapeutics, uniQure, Deciphera Pharmaceuticals, Blueprint Medicines, Mirati Therapeutics

OrbiMed Holdings

Worldwide Healthcare Trust PLC top holdings as of July 31:

- Takeda Pharmaceutical 8.3%

- Boston Scientific 6.5%

- Merck & Co 4.9%

- Alexion Pharmaceuticals 4.4%

- Novo Nordisk 3.4%

- Novartis 3.3%

- Neurocrine Biosciences 3.2%

- Edwards Lifesciences 3%

- Wright Medical 2.9%

- Abbott Laboratories 2.8%

Biotech Growth Trust PLC top holdings as of July 31:

- Vertex Pharmaceuticals 9.2%

- Neurocrine Biosciences 7.4%

- Sarepta Therapeutics 6%

- Gilead Sciences 5%

- Alexion Pharmaceuticals 4.7%

- Apellis Pharmaceuticals 4.3%

- Amgen 4.3%

- MeiraGTx 4.2%

- Exelixis 3.9%

- Deciphera Pharmaceuticals 3.9%

— With assistance by Anna Edney

By Tatiana Darie

bloomberg.com